How Is Demand for Aesthetic Products Fueling Metal Polish Sales in India?

The Reserve Bank of India (RBI) data reveals that the per capita gross national disposable income of India increased from INR 1,44,524 crore in the financial year (FY) 2018–2019 to INR 1,54,349 crore in FY 2019–2020. The apex bank also states that the gross national disposable income of the country grew from INR 1,91,78,372 crore in FY 2018–2019 to INR 2,01,28,484 crore in FY 2020–2021. The surge in disposable income has improved the living standards of the people, owing to which the country is observing the large-scale adoption of aesthetically enhanced products.

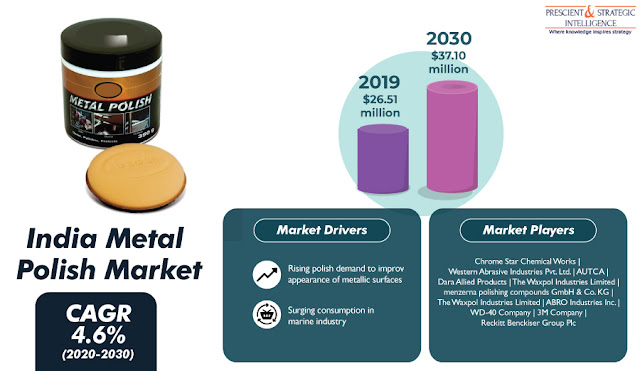

Thus, the increasing consumption of aesthetically improved products will drive the Indian metal polish market at a CAGR of 4.6% during the forecast period (2020–2030). According to P&S Intelligence, the market revenue stood at $26.51 million in 2019 and it will reach $37.10 million by 2030. The growth can also be credited to the surging use of metal polishes in the marine industry. These polishes are used on a cargo ship and boat railings and metal fittings to remove tarnish, surface rust, and corrosion caused by air, saltwater, and prolonged exposure to ultraviolet (UV) rays.

The distribution segment of the Indian metal polish market is classified into supermarkets/hypermarkets, department/convenient stores, and others. Among these, the department/convenience stores category generated the highest revenue in 2019, and it is expected to continue this trend throughout the forecast period. The dominance of this category can be ascribed to the fact that general stores are more easily accessible than hypermarkets/supermarkets. Moreover, the restricted knowledge about online modes of shopping increases the footfall of residential users and industrial workers in departmental and convenience stores.

Currently, the Indian metal polish market is consolidated in nature due to the presence of few players, such as The Waxpol Industries Limited, Reckitt Benckiser Group plc, menzerna polishing compounds GmbH & Co. KG, 3M Company, Dara Allied Products, WD-40 Company, Western Abrasive Industries Pvt. Ltd., ABRO Industries Inc., Chrome Star Chemical Works, and Pitambari Products Pvt. Ltd. In 2019, 3M Company accounted for the largest market share due to its strong distributor network and extensive supply chain in India.

Thus, the increasing shift of people toward aesthetically appealing products and the surging need for corrosion-resistant products in the marine industry will augment the use of metal polishes in India.

Read More: https://www.psmarketresearch.com/market-analysis/india-metal-polish-market

Comments

Post a Comment